ev tax credit 2022 status

We are currently updating sales estimates through December 31 2021 for the automakers. If you purchased a Nissan Leaf and your tax bill was 5000 that.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Place an 80000 price cap on eligible EVs.

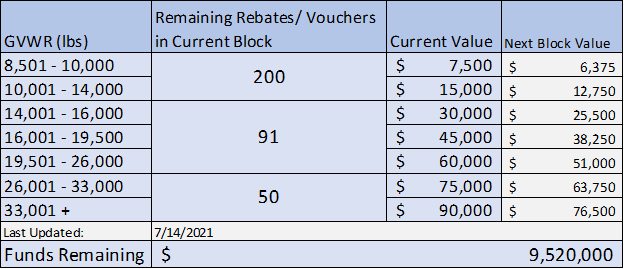

. Jan 05 2022 at 829pm ET. 2022 Calendar Year Federal Poverty Level Information. Rebates of up to 7500 dollars as proposed by the governor arent Continue Reading WA Legislature Sends.

As more electric vehicles reach dealer showrooms EV tax credits are stuck in a legislative limbo according to observers on Capitol Hill. But theyre both also nearing their 200000-vehicle ceiling that soon triggers the end of the full 7500 EV tax credit. TOM BANSE Listen Read If you were holding off buying an electric car in hopes of getting a generous Washington state rebate on top of the federal incentives you may be disappointed.

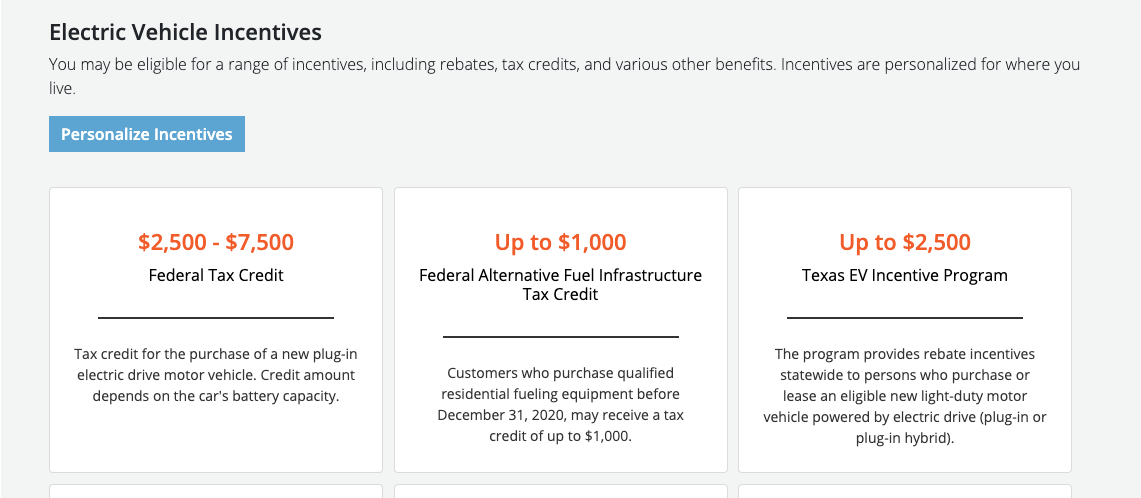

The State of Texas offers a 2500 rebate for buying an electric car. Yes there are still electric car tax credits available in 2022. Texas EV Rebate Program 2000 applications accepted per year.

President Bidens EV tax credit builds on top of. Plug-in cars charge up at the Washington State Capitol Campus. News World Report how much the EV tax credit can save you largely depends on your tax status making it important to speak with a tax professional before finalizing your purchase.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Consequently the only battery EVs that will still be eligible for the tax credit will be the Hyundai Ioniq Electric 34250 Hyundai Kona.

The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. However you should keep in mind that cars are disappearing off of the federal list as these companies sell more units. The second document made further changes.

At the end of 2021 the total of electrified vehicles that Toyota sold that met the requirements to earn a portion of the federal tax credit stood at 190047 units. The amount of the credit will vary depending on the capacity of the battery used to power the car. The full EV tax credit will be available to individuals reporting adjusted gross incomes of 250000 or less 500000 for joint filers decreased from 400000 for individuals800000 for joint.

Joseph Szczesny Executive Editor. What Is the New Federal EV Tax Credit for 2022. We took a look at how the timing might work out.

In fact there are more state and local incentives than in years before. Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market.

The logjam on Capitol Hill also means buyers of EVs from General Motors and Tesla remain. 76 rows Status of the 12500 federal tax credit for EVs. Federal Tax Credit 200000 vehicles per manufacturer.

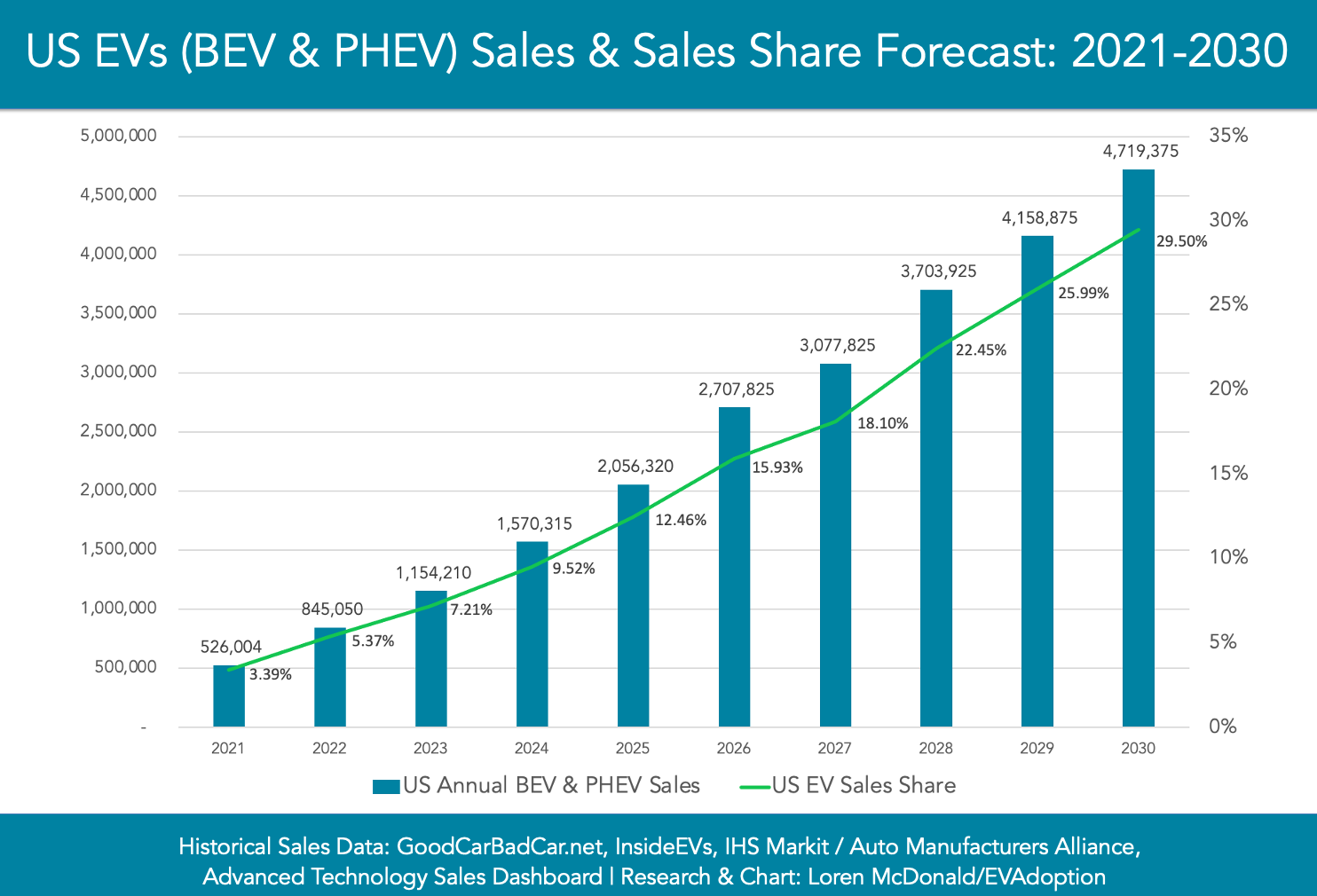

Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold likely in Q1 of 2022. Create an additional 2500 credit for assembled in the US. The effective date for this is after December 31 2021.

Toyota is on the verge of running out of federal tax credits in the US as the Japanese company has sold more than 190000 plug-in electric cars. QUALIFIED EDUCATION EXPENSE TAX CREDIT January 31 2022 The Qualified Education Expense Credit Cap is 100 million 2022 Year. If thats the case you could save up to 7500 on the EV pickup.

As such there is 18136522 remaining in the cap. Sales of electric vehicles like the Ford Mustang Mach-E have been on the rise. Like leasing an EV buying a used electric auto also does not allow you to claim the traditional EV tax credit.

For preapprovals processed through the date of this report 81863478 of the 100 million cap has been preapproved. The US Federal tax credit is up to 7500 for an buying electric car. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal.

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. State and municipal tax breaks may also be available. But that could change.

Now say the 2022 Ford F-150 Lightning is eligible for EV tax credits. Create an additional 2500 credit for union-made EV. Does your electric vehicle qualify for.

EVAdoption will update our Federal EV tax credit phase-out tracker a few times per year so check back on a regular basis. A refundable tax credit is not a point of purchase rebate. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an.

However according to US. New EV Federal Tax Credit Update. The outlet claims that Toyota is set to cross the 200000-unit threshold in the first quarter of 2022.

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopReasonsToBuyEV.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

Rebates And Tax Credits For Electric Vehicle Charging Stations

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Incentives Austin Energy Ev Buyers Guide

Ev Incentives Ev Savings Calculator Pg E

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Wisconsin Solar Incentives Rebates And Tax Credits Sunrun

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

What Is An Electric Vehicle Tax Credit

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

These 5 Plugin Vehicle Models Would Benefit Most From Proposed Us Ev Tax Credit Update Chart Cleantechnica

2021 Jeep 4xe Hybrid Tax Credits Incentives By State

How Electric Vehicle Tax Credits Work

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa